| Navigation: Templates > Guide to all Templates > Additional Libraries and Templates > Finance Library >====== PV (present value) ====== |    |

PV(periods,rate,payment,futurevalue)

| PV | Computes the present value required to reach a targeted future value. |

| periods | A numeric constant or variable containing the number of periods in which a cash flow occurred. |

| rate | A numeric constant or variable containing the periodic rate of return. |

| payment | A numeric constant or variable containing the periodic payment amount. |

| futurevalue | A numeric constant or variable containing the amount of the desired or targeted future value of the investment. |

PV determines the present value required today to reach a desired amount (futurevalue) based upon the total number of periods (periods), a periodic interest rate (rate), and a payment amount (payment). If payments occur at the beginning of each period then use the PREPV function, which takes into account the added interest earned on each period's payment.

Periodic rate may be calculated as follows:

PeriodicRate = AnnualInterestRate / (PeriodsPerYear * 100)

If the present value is less than the future value (annuities), payments are positive, and conversely, if the present value is greater than the future value (loans), payments are negative.

Return Data Type: DECIMAL

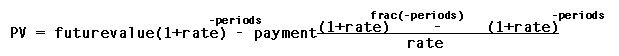

Internal Formulas:

where frac(periods) is the fractional portion of the periods parameter.

Example:

PeriodicRate = AnnualRate / (PeriodsPerYear * 100)

IF TimeOfPayment = 'Beginning of Periods'

PresentValue = PREPV(TotalPeriods,PeriodicRate,Payment,FutureValue)

ELSE

PresentValue = PV(TotalPeriods,PeriodicRate,Payment,FutureValue)

END