| Navigation: Templates > Guide to all Templates > Additional Libraries and Templates > Finance Library >====== IRR (internal rate of return) ====== |    |

IRR(investment,cashflows,periods,rate)

| IRR | Computes the internal rate of return on an investment. |

| investment | A numeric constant or variable containing the initial cost of the investment (a negative number). |

| cashflows[] | A single dimensioned DECIMAL array containing the amounts of money paid out and received during discrete accounting periods. |

| periods[] | A single dimensioned DECIMAL array containing period numbers identifying the discrete accounting periods in which cash flows occurred. |

| rate | A numeric constant or variable containing the desired periodic rate of return. |

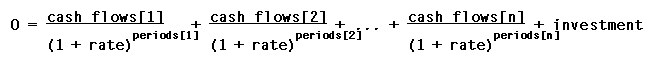

IRR determines the rate of return on an investment (investment). The result is computed by determining the rate that equates the present value of future cash flows to the cost of the initial investment. The cashflows parameter is an array of money paid out and received during the course of the investment. The periods parameter is an array which contains the period number in which a corresponding cash flow occurred. The desired periodic rate of return (rate) for the investment is also specified. Investment should contain a negative number (a cost).

Periodic rate may be calculated as follows:

PeriodicRate = AnnualInterestRate / (PeriodsPerYear * 100)

Cashflows and periods MUST both be DECIMAL arrays of single dimension and equal size. The last element in the periods array MUST contain a zero to terminate the IRR analysis.

Return Data Type: DECIMAL

Internal Formulas:

The IRR function performs binary search iterations to home in on the return value. If more than 50 such iterations are required, a value of zero is returned.

Example:

CashFlows DECIMAL(18,2),DIM(1000)

CashFlowPeriods DECIMAL(4),DIM(1000)

InvestmentAmount DECIMAL(18,2)

DesiredInterestRate DECIMAL(31,15)

Return DECIMAL(10,6)

InvestmentTransactions FILE,DRIVER('TOPSPEED'),|

NAME('busmath\!InvestmentTransactions'),PRE(INV),CREATE,THREAD

KeyIdPeriodNumber KEY(INVTRN:Id,INVTRN:PeriodNumber),NOCASE,PRIMARY

Notes MEMO(1024)

Record RECORD,PRE()

Id DECIMAL(8)

PeriodNumber DECIMAL(8)

Date ULONG

Type STRING(20)

Amount DECIMAL(16,2)

END

END

CODE

CLEAR(CashFlows) !initialize queue

CLEAR(CashFlowPeriods) !initialize queue

CLEAR(InvestmentAmount)

CLEAR(TRANSACTION:RECORD) !initialize record buffer

DesiredInterestRate = INV:NominalReturnRate / (100 * INV:PeriodsPerYear)

transcnt# = 0

TRANSACTION:Id = INV:Id !prime record buffer

TRANSACTION:PeriodNumber = 0

SET(TRANSACTION:KeyIdPeriodNumber,TRANSACTION:KeyIdPeriodNumber) !position file

LOOP !loop for all transactions

NEXT(InvestmentTransactions) !read next record

IF ERRORCODE() OR TRANSACTION:Id NOT = INV:Id !if no more transactions

BREAK !break from loop

ELSE !else process transaction

transcnt# += 1

CashFlows[transcnt#] = TRANSACTION:Amount

CashFlowPeriods[transcnt#] = TRANSACTION:PeriodNumber

END !endelse process transaction

END !endloop all transactions

Return = IRR(InvestmentAmount,CashFlows,CashFlowPeriods,DesiredInterestRate)

Return *= (100 * INV:PeriodsPerYear) !normalize IRR to percent