| Navigation: Templates > Guide to all Templates > Additional Libraries and Templates > Finance Library >====== PRERATE (rate of annuity with prepayment) ====== |    |

PRERATE(presentvalue,periods,payment,futurevalue)

| PRERATE | Computes the periodic interest rate required to reach a targeted future value. |

| presentvalue | A numeric constant or variable containing the present value of the investment. |

| periods | A numeric constant or variable containing the number of periods in which a cash flow occurred. |

| payment | A numeric constant or variable containing the periodic payment amount. |

| futurevalue | A numeric constant or variable containing the amount of the desired or targeted future value of the investment. |

PRERATE determines the periodic interest rate required to reach a desired amount (futurevalue) based upon a starting amount (presentvalue), the total number of periods (periods), and a payment amount (payment). If payments occur at the end of each period then use the RATE function, which calculates interest accordingly.

If the present value is less than the future value (annuities), payments are positive, and conversely, if the present value is greater than the future value (loans), payments are negative.

Return Data Type: DECIMAL

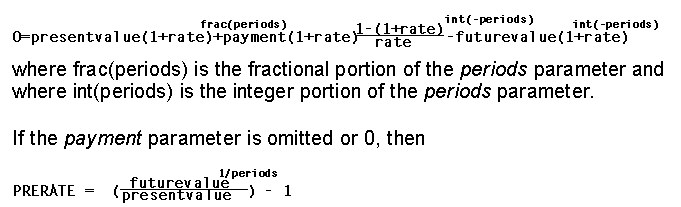

Internal Formulas:

The PRERATE function performs binary search iterations to home in on the interest rate value. If more than 50 such iterations are required, RATE returns a value of zero.

Example:

IF TimeOfPayment = 'Beginning of Periods'

AnnualRate = PRERATE(PresentValue,TotalPeriods,Payment,FutureValue)

AnnualRate *= (PeriodsPerYear * 100)

ELSE

AnnualRate = RATE(PresentValue,TotalPeriods,Payment,FutureValue)

AnnualRate *= (PeriodsPerYear * 100)

END